OptionsLive - next generation options trading platform

Background

OptionsLive is an options trading and analytics platform that started as an internal project at ED&F Man Captial Markets in New York. This platform connects to the Chicago Mercantile Exchange (CME) using a direct API to provide traders with real-time analytics and fractional pricing. This new app drives cost savings and uncovers the best trading opportunities for financial professionals.

David Hoffman and Jason Margiotta, the two creators of OptionsLive, built the prototype in a spreadsheet. Once this initial concept was proven successful, they knew it needed to be developed on a modern platform. Jason had experience programming in Python and started building out the application. He succeeded in getting the concept off the ground and reached the point where he needed help connecting the platform to the CME.

OptionsLive approached Connamara, a FinTech firm based in Chicago, to help build out the platform. Connamara had deep financial market experience and brought in the full-stack dev team from Creative Mines to complete the frontend and backend development.

David and Jason met with Creative Mines to discuss this ambitious project. Creative Mines had extensive experience with the CME, electronic trading systems, and Python, making for a natural fit. OptionsLive was excited to partner with Creative Mines to build a reliable, high-performant market data service, a custom API, and a modern web app.

Services Provided

- Backend Development

- Frontend Development

- QA and Software Testing

The Scope

The task was to help out on the backend, get the platform connected to the CME, and build a modern, interactive web app on the frontend.

Market Data Adapter

The original prototype used data from a market data aggregator. OptionsLive wanted direct access to the CME market data for interest rate options. The job was to connect the platform to the CME and adapt that market data to a format the OptionsLive algorithm could read.

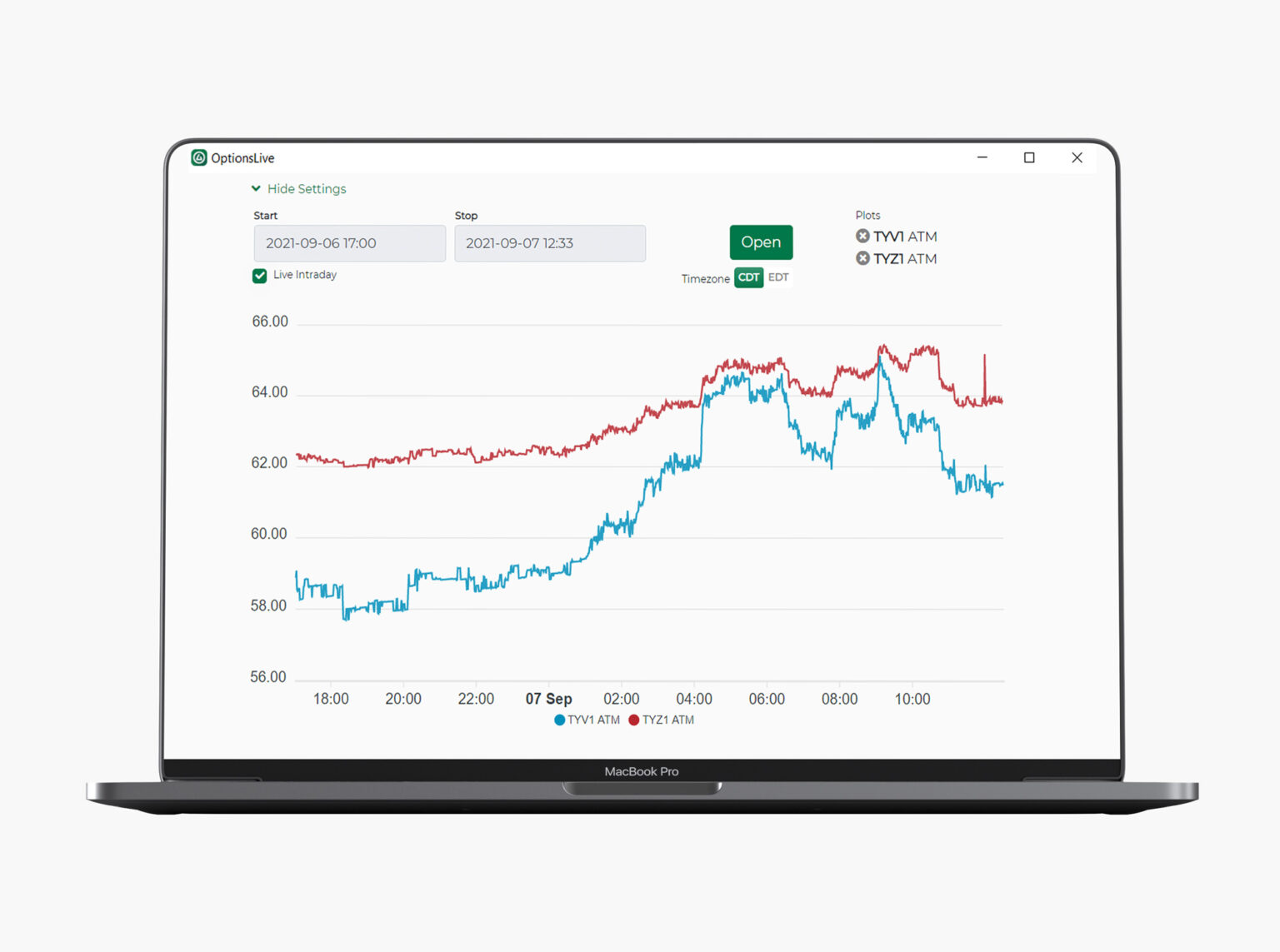

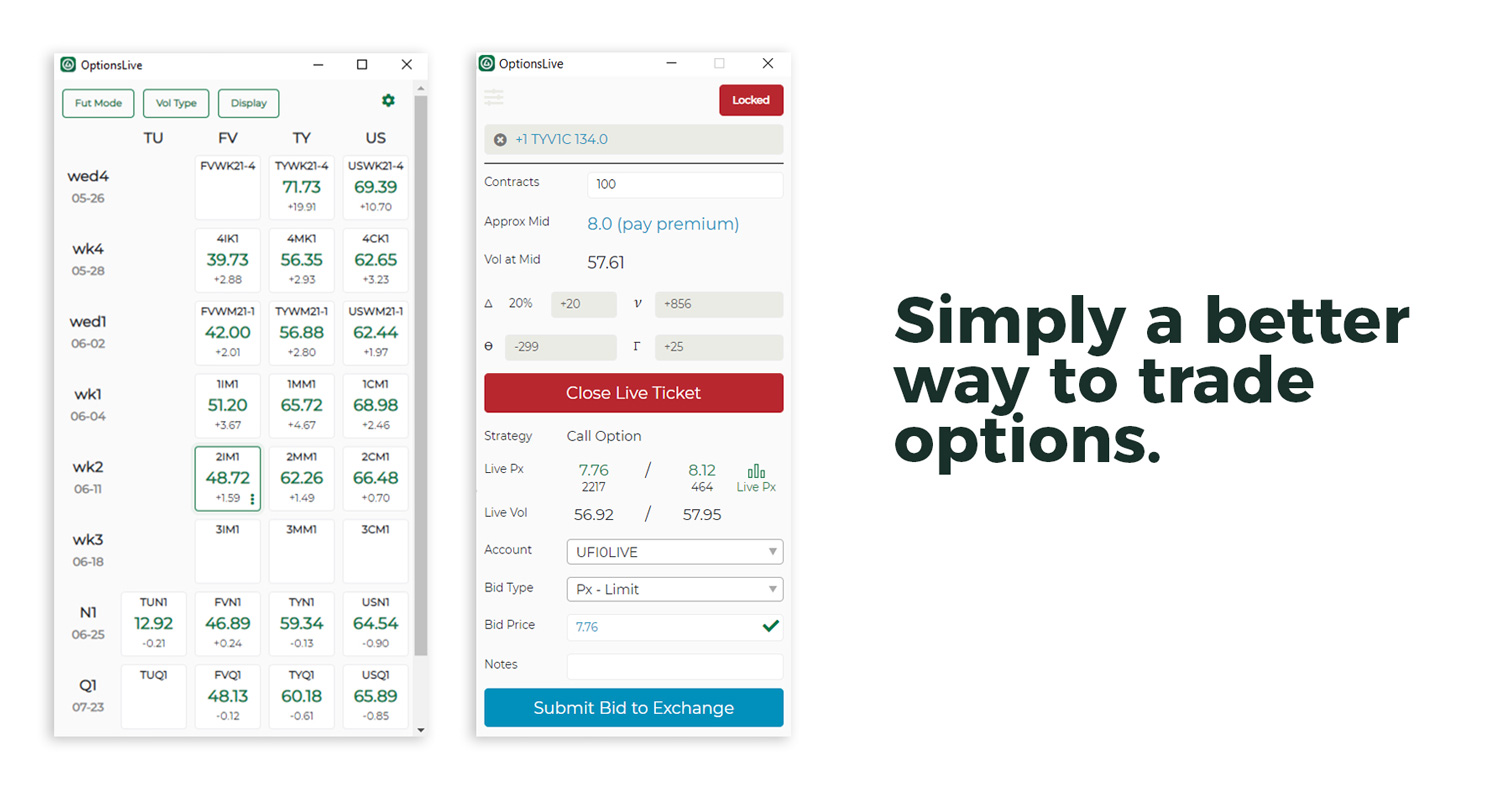

Frontend Web App

The second part of the project was building a hybrid web app and desktop app to allow users to trade options quickly. The platform needed to display a large amount of data while remaining fast and easy to navigate.

The Challenges

Timeline Challenges

The OptionsLive founders wanted to launch the app quickly which made for a tight project timeframe. The frontend needed to be live as soon as possible so traders could start using it. David and Jason also wanted to see a return on their time and money invested in the platform.

Technology Challenges

This high-performance market data system was initially running in a virtualized environment which presented many challenges. First, there was a massive amount of data flowing between the platform and the CME. The virtual machine had to be tuned to keep up with the spikes that occurred during the trading day. The development team ran into another challenge that was unique to virtual machines. When noticing dropped packets at regular intervals, the team uncovered an issue with the virtual machines being paused every hour to create a backup.

Our Solution

The full-stack development team deeply understood the nature of the system and was confident in delivering a high-quality product within the targeted time frame. The team started first on the market data adapter. The messages from the exchange had to be processed into a format that the OptionsLive algorithm could easily use to run its analytics.

The prototype software was running on a virtual machine and was having difficulty keeping up with the amount of data being transferred. Connamara and Creative Mines worked together to tune the adapter first by migrating to PyPy, a Python implementation that kept the same features of Python while increasing the performance through the use of a just-in-time compiler. Working with the operations team, the dev team also configured the virtual machine specifically for high-performance applications.

The platform connected to the CME, connectivity challenges were solved, onboarding was done, and the certifications were completed. Internally, the team architected a solution that used ZeroMQ to communicate between the market data adapter and services. This allowed a lot of the pieces from the desktop app to be moved to backend services that the web application could then use. After the initial architecture was complete, the backend was implemented and the team moved on to the web application.

The web application was built on top of OpenFin, a desktop platform that allows firms to use web apps in an integrated desktop manner. For financial technology professionals and traders, a dynamic display with many screens (news, tickers, trading interfaces, etc.) that are all integrated is a must-have feature. The new app allowed traders to use OptionsLive as part of their trading operations, combined with all the other things they’re doing.

Being a team of full-stack developers allowed the Creative Mines team to build a very well-integrated application from back to front and allowed them to modify the frontend and backend together so they could evolve together. This process made for a more seamless developer experience and project experience. In the end, the dev team was able to deliver things faster by doing the full-stack implementation.

"The market data adapter that Creative Mines developed has been reliable and performant from day one."

Jason Margiotta

Managing Director, ED&F Man Capital Markets

The Results

A new API was created with a rich interface and powerful analytics experience on top of it. This platform didn’t exist elsewhere and proved to be a valuable tool for financial traders.

Soon after OptionsLive was launched, the app was handling 5% of the options trading on the CME as a whole. This makes OptionsLive the largest commercial user of the CME Direct API. The platform is being used within six financial centers across four different continents. Financial professionals across the globe can view deep analytics, uncover the best trade opportunities, and place trades quickly with this platform.

Using a full-stack implementation, the software development team created a seamless user experience that was highly responsive to user inputs. The performance was also better because the team could think of implications throughout the application’s entire life cycle.

4

OptionsLive is being used across four continents

5%

of options traded on CME

6

OptionsLive is used within six financial centers